(Last updated on: March 24, 2014)

For service charges or sales tax to be applied to all sales, go to File | Payment types.

For service charges or sales tax to be applied to ONLY ONE performance, read this post.

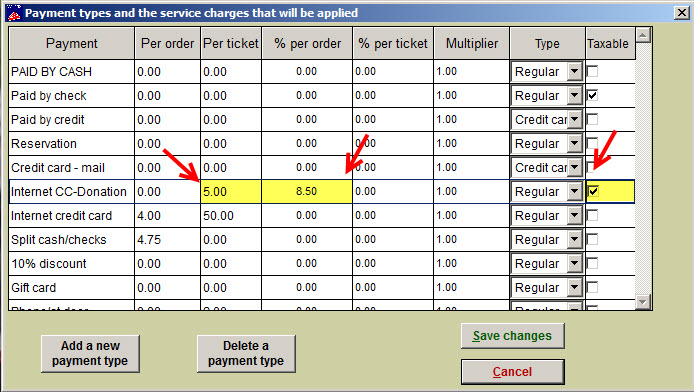

A regular service charge can be a dollar amount charged per order or per ticket, as well as a percent per order or per ticket. In the example below, we are setting up fees for the payment type “Internet credit card” (online sales). We are charging a $5 service fee. We are also charging an 8.5% sales tax and have listed that in the “% per order” column. Once these values have been input, they will apply to all sales for that payment type. Do this for all applicable payment types.

NOTE: For all payment types that you attach a % charge to (either per order, or per ticket), you MUST have the box in the column ‘Taxable’ checked.